Another Spring, another round of totally uninformed and illogical arguments about gas prices.

You could be forgiven if you’re feeling some deja vu. As conservatives and Congressional Republicans scramble to blame the president for rising gas prices, you might have the feeling that we’ve been here before.

Oh, that’s right. It was just last year (almost exactly a year ago, actually) that prices were pushing towards $4 per gallon, and everyone from Sarah Palin (in a ludicrously misguided and ill-informed Facebook rant) to Speaker Boehner were misplacing blame for pump prices.

Anyone who takes the time to actually look into it can pretty easily learn that the president alone can’t do much about rising gas prices, through expanded drilling or approving pipelines or whatever else.

The AP just ran a definitive piece that looked at 36 years of data, and found “no statistical correlation between how much oil comes out of U.S. wells and the price at the pump.”

And here are twenty experts from across the political spectrum (including the staunchly conservative American Enterprise Institute and the Cato Institute) stating clearly that domestic drilling has no real effect on gas prices.

A full 92% of economists surveyed replied that gas prices are set by external market forces, and not domestic policies. Even Fox News reported in 2008 that “no President has the power to increase or to lower gas prices.”

Still, the disinformation flies, and so I’ll throw another fact-based argument in the mix. You want more proof that we can’t drill or pipeline our way to lower gas prices? Look north, to Canada.

Remember, Canada exports more oil than it imports. If only we could get more of that ”ethical oil” (cough cough) we’re always told, Americans’ pain at the pump would ease.

Except, it wouldn’t. It would actually raise the price of gas for many Americans by as much as 20 cents per gallon.

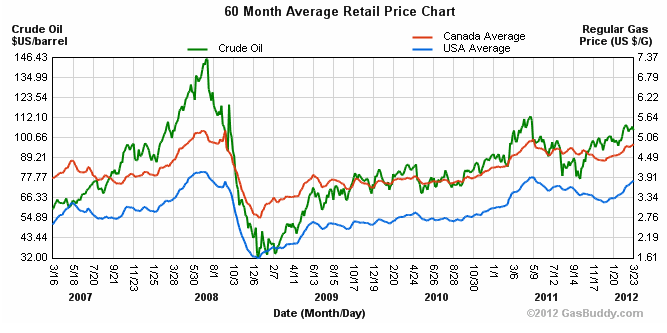

Let’s start with a very revealing chart:

The red line is the average price of gasoline in Canada, and the blue line represents the price in the United States. The green line is the price of crude oil. See for yourself on GasBuddy.com. As even a first grader could tell you, the three lines—while not equal—follow the same track.

But there is more to it. The United States and Canada are both big oil producers, but Canadians actually export a lot of the oil that they produce.

NRDC‘s Deron Lovaas, who originally posted a link to these charts last year (when the hype was the same), explains:

And Canada? Canada produces about 3.3 million barrels a day, and consumes almost 2.2 million barrels daily. Canada is a big net-exporter, sending a lot of fuel, for example, into U.S. gas tanks.

But prices at Canadian pumps have tracked ours (setting aside a regular gap due mostly to higher Canadian fuel taxes) since 2007. And both have been pulled up and down and up again by a spiky, scary global crude oil price roller coaster.

Canada, with its vast resources and small population, can’t drill its way out of price runups because they’re shackled to a global oil marketplace. And we are too.

So if we really want to know what would happen to U.S. gas prices were we not only to drill more, but to somehow drill so much more that we were able to produce more than we consume, we simply look to Canada.

…Canada, where the vast tar sands oil reserves and net exports of oil are doing nothing to ease their own pain at the pump.

…Canada, that nation to our north where people pay more for gasoline than we do, and where their gas prices have tracked ours—up and down, on the wild OPEC “roller coaster ride.”

Don’t expect the “blame Obama” talking point to go away, but please do spread the word that it is a total farce. Just ask a Canadian.

Image credit: Gas nozzle-cide | Shutterstock

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts