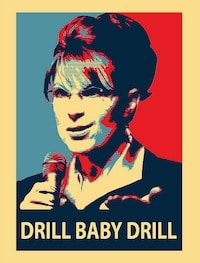

It is hard to believe that it’s been almost four years since Americans were bombarded by the cry of “Drill baby, drill” that echoed throughout the halls of the Republican National Convention in 2008. That slogan became a rallying cry for conservatives who believed that increasing oil drilling – in spite of the environmental costs – would lead to an economic boom in the United States, and would also help ease prices at the pump for American consumers.

So today, nearly four years after those words were uttered to millions of conservatives, we have domestic oil production reaching a 24-year high, according to new reports. By industry and conservative logic, this should also mean that economic productivity has risen while consumer gasoline prices have fallen. But nothing could be further from the truth.

It turns out that increased oil production has nothing to do with the prices Americans pay at the pump. While industry leaders point to increased production in 2008 that was followed by lower prices, experts counter that the drop in price was due to simple market fluctuations: specifically, a drop in demand due to the global recession.

People travelled less and therefore didn’t use as much gasoline, creating a surplus that companies had to expel by lowering prices. These same experts also say that a rise in renewable energy use contributed to lower fossil fuel prices during this time period.

The truth is that the United States just doesn’t have enough fossil fuels to bring down the price of energy for American consumers. Even with our current rise in domestic fossil fuel production, prices continue to rise or remain steady without any signs of falling. The reason for this is because OPEC sets oil prices on the international stage.

When the United States increases their oil production, those figures are sent to OPEC, who then adjust the global price of oil based on our own production. Experts say that opening up all of our available areas to drilling, once factored into OPEC equations, would only reduce gasoline prices by a mere three cents per gallon, and that price drop would only last a few years.

Interestingly enough, industry leaders are still beating the (oil) drum for increased drilling and domestic oil production, even as oilrigs are sprouting up across the country, to almost no one’s benefit except the oil companies. And they are being aided along the way with their allies from conservative think tanks, conservative media, and Republican politicians.

In fact, Republicans in Congress have been so eager to open up new lands for drilling – again, in spite of the fact that drilling is occurring at a record pace – that they held 20 hearings on ways to speed up the permitting and drilling process in the last year. This was during a year where oil drilling had increased a staggering 60% since the previous year. (Think Progress has a chart showing the dirty energy industry campaign donations that went to the politicians holding these meetings.)

Even today, the U.S. Chamber of Commerce continues to urge President Obama to “#getserious” about domestic energy production by increasing the lands available for energy industry exploitation.

As mentioned above, there are two factors that have been proven to lower fuel prices – economic recession and replacing fossil fuels with renewable energy. And both of those factors work the same way, which is to decrease the demand for fossil fuels. Until demand falls, the industry has absolutely no reason to lower prices. In fact, the companies are legally required to do all that they can to protect their profits and the “best interest” of their shareholders, so lowering prices because of increased production is not even an option that is on the table.

It is doubtful that the industry, and those with financial or political ties to the dirty energy industry, will ever concede the fact that increased oil drilling will not lower energy prices. But the facts are not on their side, so no matter how often they repeat those talking points they will never be truthful.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts