As energy companies scramble to develop the Marcellus Shale and other natural gas reserves locked up in shale formations, you’ll hear a lot about American “energy security” and reducing dependence on fossil fuel imports. You won’t hear a lot about companies’ plans to export the gas.

It’s becoming clear, however, that gas companies like Dominion Resources and Jordan Cove have big plans for exporting the natural gas that they’re rushing to frack.

First, some background. To export or import natural gas, companies can either transport it through pipelines, or ship it as liquefied natural gas (LNG). LNG is natural gas cooled to -260 degrees Fahrenheit, at which point the gas becomes a liquid.

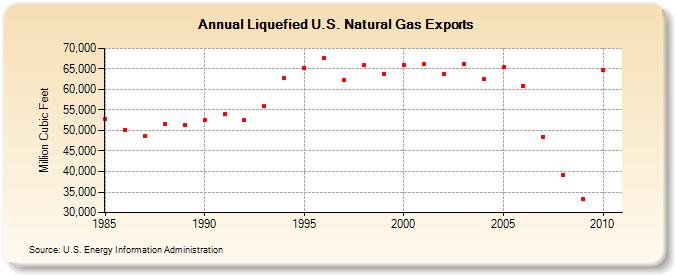

Currently, the vast majority of natural gas exports from the United States travel through pipelines into Mexico and Canada. Of the 1,136,789 million cubic feet of natural gas exported from the United States in 2010, only 64,763 million cubic feet were exported as liquefied natural gas. In other words, only about 5 percent of natural gas exports currently leave our borders as LNG from coastal ports.

In 2010, the U.S. exported LNG to Brazil, India, Japan, South Korea, Mexico, Spain, and the United Kingdom.

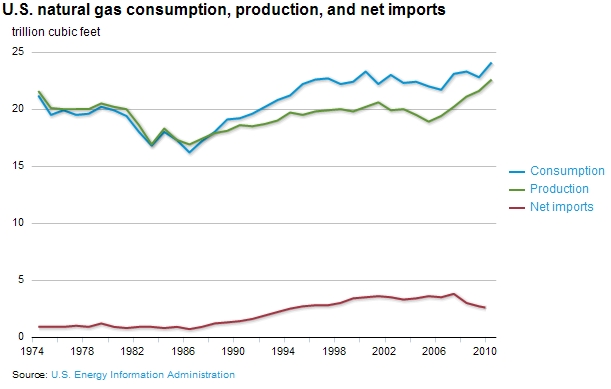

But natural gas exports are still dwarfed by imports. In 2010, the U.S. imported roughly 431,010 million cubic feet of LNG and a total of 3,740,757 million cubic feet of natural gas. So we import over three times as much natural gas as we currently export.

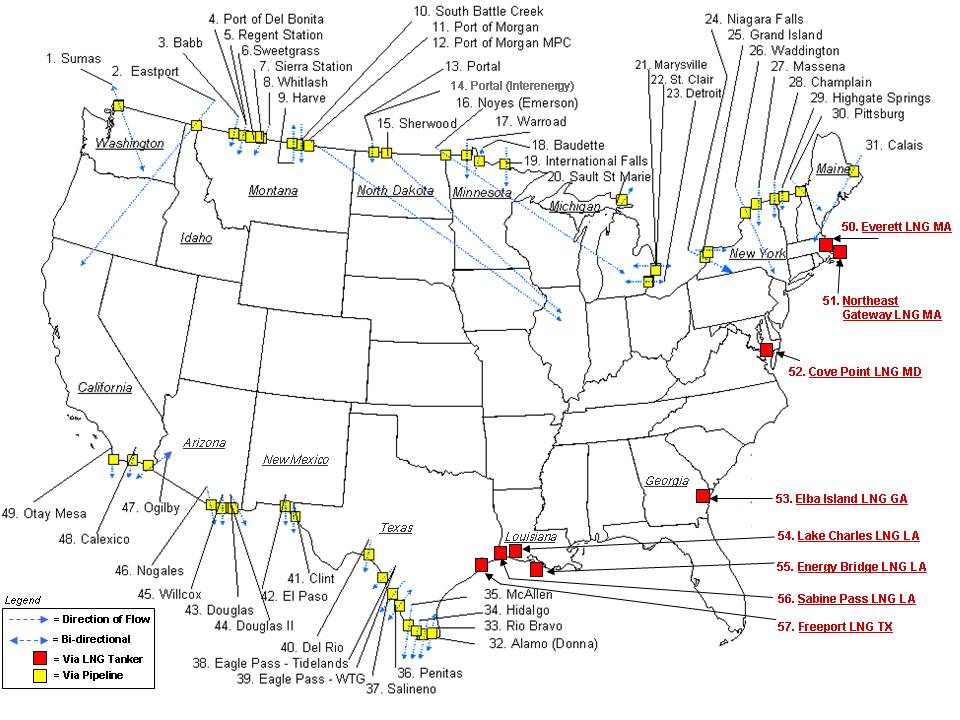

As of last year, there were 11 LNG terminals in the United States, only one of which is approved for exports. This slightly outdated map shows the locations of eight LNG terminals, marked by red boxes. (The yellow boxes show where natural gas flows in or out of the country through pipelines.)

Click on the map for a larger version.

With natural gas imports still so much greater than exports, and with current natural gas demand still outstripping domestic supply, it’s curious that domestic natural gas producers like Dominion Resources are trying to gain approval to export LNG, as this recent piece in the Wall Street Journal describes.

Dominion operates an LNG facility in Cove Point, Maryland that has the geographical advantage of being the closes LNG port to the massive Marcellus and Utica Shale plays. Thomas F. Farrell II, chairman, president and chief executive officer of Dominion told the News-Register of Wheeling, West Virginia, “The facility is particularly well-situated to export gas production from the prolific Marcellus Shale and promising Utica Shale formations.”

Across the country, there’s a similar scene. Last month, the Jordan Cove Energy Project petitioned FERC to approve exports of LNG at its planned terminal in Coos Bay, Oregon.

Who exactly is behind the Jordan Cove Energy Project? Two foreign energy companies. Energy Projects Development, with offices in London and the United Arab Emirates, and Calgary, Alberta-based Fort Chicago. How likely is it that Jordan Cove, with foreign owners and stakeholders, is asking for export permission in the interest of American energy security?

While Dominion is based in Virginia, their claims for the necessity of the export terminal don’t quite add up. “It is in our nation’s best interests to develop our natural resources responsibly and reliably,” Dominion chief Farrell said. “In the process, we will be able to improve the nation’s balance of trade.”

Of course, if the “nation’s best interests” were the gas drillers’ concern, they would sell the Marcellus production domestically and thereby reduce imports. But companies aren’t actually operating in the interest of providing American energy security or “improving balance of trade.” They’re trying to open the valves wide to cash in as quickly as possible on these massive shale plays – wherever the markets exist – before anyone slows them down.

Shale development involving hydraulic fracking and horizontal drilling is sold to the American public and to locally-impacted communities as a great boon for American energy security and self-reliance. But in reality, much of that shale gas pumped out of the Marcellus and other shale deposits is going to flow immediately outside our borders to markets with higher prices, making the big companies richer and leaving Americans just as energy poor – and cleaning up the industry’s messes too.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts